A Guide to Paying Your Irish Taxes by Direct Debit

As a business owner or Income Tax payer in Ireland, managing your tax obligations can sometimes feel like a daunting task. Between keeping track of deadlines, ensuring you’re paying the right amounts, and avoiding any penalties, it’s easy to get overwhelmed.

However, did you know you can simplify your tax payments by using Direct Debits?

It’s a convenient and efficient way to ensure your taxes are paid on time—every time!

In this blog, we’ll walk you through which taxes can be paid by Direct Debit and how to set it up.

What Taxes Can Be Paid by Direct Debit?

In Ireland, several taxes can be settled through Direct Debit. This method is not only efficient but also helps businesses avoid the stress of manual payments. Here’s a breakdown of the main taxes you can pay via Direct Debit:

- Pay as You Earn (PAYE) – If you’re running payroll, you’ll need to remit PAYE,PRSI (Pay Related Social Insurance), and USC (Universal Social Charge) contributions to Revenue. Setting up Direct Debits for these payments ensures that they are made on time, without any hassle.

- Value Added Tax (VAT) – VAT is a common tax for businesses in Ireland. You can easily pay your VAT liability through Direct Debit. Whether you’re filing monthly, quarterly, or annually, Direct Debit ensures your payments are automatic and on schedule.

- Income Tax (Self-Assessment) – If you’re a sole trader or a director of a company, you may need to pay Income Tax through self-assessment. Direct Debit makes it easier to stay on top of your tax obligations, whether you’re making preliminary or balancing payments.

- Local Property Tax (LPT) – Businesses that own property may also be subject to Local Property Tax. This can be paid via Direct Debit, ensuring your property taxes are settled regularly without you having to worry about it.

Why Choose Direct Debit for Tax Payments?

Opting for Direct Debit payments has a number of benefits for Irish businesses:

- Convenience: Set it up once, and your payments are automatically deducted from your account on the due date.

- No Missed Deadlines: Automated payments help you avoid late fees and penalties from missed deadlines. Tax arrears are avoided as all taxes are being paid on a current basis.

- Better Cash Flow Management: Since payments are scheduled, you can plan ahead and manage your business’s cash flow more effectively. This is particularly true for payments of annual taxes such as Income Tax, where payments can be spread into 12 equal instalments, rather than facing a large, lumpsum payment all at once. Which in turn can help avoid strain on your finance as the payment deadline approaches.

- Peace of Mind: Once set up, you can rest easy knowing that your taxes are being paid on time, without the need for constant manual intervention.

How to Set Up A Direct Debit for Your Business Taxes

Setting up Direct Debits with Revenue is straightforward. Follow these simple steps:

- Log in to ROS (Revenue Online Service):

To start, you need a Revenue Online Service (ROS) account. If you don’t have one, you can register on the Revenue website. - Go to the ‘Payments & Refunds’ section

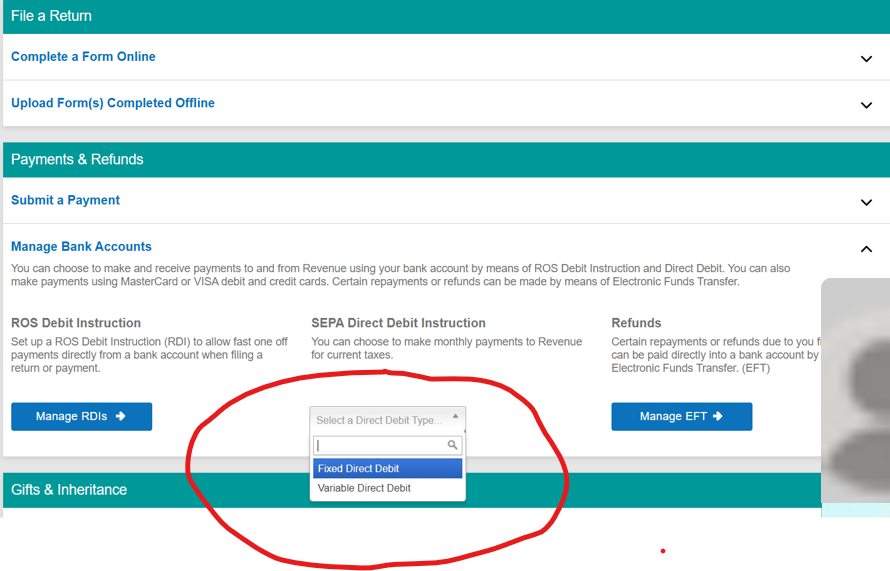

- Choose Fixed or Variable Direct Debit type: Within the “Payments & Refunds” section, select either ‘Fixed’ or ‘Variable’.

- A fixed Direct Debit means that you pay a set amount on a regular basis, regardless of any fluctuations in your tax liability eg. €500 per month.

- A variable Direct Debit, on the other hand, adjusts according to the amount you owe to Revenue. For example, if the payroll liability for January is €450, then the amount of €450 will be taken on the due date, and if the payroll liability for February is €525, then the amount of €525 will be paid on the due date. The direct debit amount will be matched to the relating return filed.

- Select the tax type you wish to set up for Direct Debit (e.g., PAYE, VAT, Income Tax, etc.).

- Tick the box to state that you agree with the terms and conditions

- Confirm Your Details:

Ensure your bank account details are correct, as payments will be automatically deducted from this account. - Set date for first debit

- For some taxes, you will have a choice of date for payment.

- Where Preliminary Income Tax is being paid, the date is always the 9th of each month

- Set Your Payment Schedule:

Depending on the tax type, you’ll need to specify whether you want monthly, quarterly, or annual deductions. It is possible to pay certain months and suspend other months eg. you might make 10 payments during the year, but skip payments for say July & August when you might be on holidays, and when business cashflow may be leaner. - Authorisation and Confirmation:

Review all details and authorise the Direct Debit setup. You’ll receive a confirmation from Revenue, and your payments will be automatically scheduled from that point forward.

Rules On the Amount of Direct Debit

To avoid underpayments, the following minimum amounts must be paid :

a. Income Tax – 100% of the previous year, or 90% of the current year liability or 105% of the prepreceding year (which cannot be NIL).

b. PSYE/PRSI/USC – at least 90% of the final annual liability must have been paid by direct debit during the year

c. VAT – at least 80% of the final liability must have been paid by direct debit during the year

Things to Keep in Mind

- Ensure Sufficient Funds: Make sure there are enough funds in your business account to cover the Direct Debit payments, as failing to do so could lead to missed payments and penalties.

- Review Your Tax Liabilities Regularly: While Direct Debit is convenient, it’s still important to review your tax liabilities and payment schedules periodically to ensure you’re on track with your payments.

- Set Reminders for Changes: If your business changes its tax obligations or payment schedules, remember to adjust your Direct Debit settings accordingly.

- Revenue reserve the right to approve/decline any application for payment by direct debit so it is important to keep a compliant record of filing and paying within deadline.

Conclusion

Paying taxes by Direct Debit instruction is an excellent way to streamline your business’s finances and ensure you stay compliant with Irish tax laws. By automating your tax payments, you can save time, reduce the risk of missed deadlines, and focus more on growing your business.

If you need assistance setting up Direct Debit or have any questions about your business’s tax responsibilities, feel free to get in touch with us. We’re here to help you make tax time a whole lot easier!

Is your business ready to embrace the convenience of Direct Debit for tax payments? For more information and some screenshots of the Revenue screens when creating your direct debit, please see the link below: